Why I don't use Intuit's Quicken or Microsoft Money

I've been banking online as long as I've been online. I've always avoided checks, preferring to do as much as I can electronically.

I've been banking online as long as I've been online. I've always avoided checks, preferring to do as much as I can electronically.

I used QuickBooks under DOS, and ComputerServe Finance under OS/2. Even though I took "Home Economics" in school - we were all required to learn how to balance a checkbook - it never made sense to me why I should have to reconcile how much I THINK I have with how much the Bank knows I have.

I used QuickBooks, then OFX (Open Financial eXchange - arguably the first public "Web Service," even though it's SGML and bailing-wire - and moved forward as new, better personal finance managers (PFM) came out.

I diligently have exported and imported, massaged and cajoled over 20 years (yes, twenty) of financial data from my first sole-proprietorship at 15 until today moving accounts and account data from bank to bank and from PFM to PFM.

To this day, I'm convinced that Microsoft Money 95 was brilliant, wonderful and before its time. It had a forward/backward browser like metaphor and was unapologetic about it. It wasn't trying to be like the MDI (Multiple Document Interface) "peer applications" of time. It focused on one thing and one thing only - to be a local register for all your money.

Then came the fancy stuff, and the advertising and upselling. I upgraded like clockwork. Oh! A new version of money! It must be 365 days better! I paid my $49.95, then got the Deluxe the next year for $79.95, then the super Deluxe Business Edition. It got slower and slower. Remember I've got Money files with data going back decades, plural. I tried culling the data, to include just the last 10, then 5, then 2 years. Still slow. Painting slow.

Accounts open and closed, banks changed account numbers, banks changed OFX servers, things broke. I got downloaded transaction data like "JITB#45,21312323423,$%@#$@ - $4.95" and wondered why my bank was swearing at me, rather than telling me I spent $4.95 at Jack In the Box on the corner of Walker and Jenkins then plotting it on a map.

Of course, this isn't all Money's fault, it's the banks, it's the data consortiums like OFX and IFX (disclosure, I was the OFX Vendor Committee Chairman for 2 years and I suck too. I could have done a LOT more.) and it's the back end systems.

Of course, this isn't all Money's fault, it's the banks, it's the data consortiums like OFX and IFX (disclosure, I was the OFX Vendor Committee Chairman for 2 years and I suck too. I could have done a LOT more.) and it's the back end systems.

Data's not pretty, and Money and Quicken are forced to create local rules to parse out the data they get from bank and the bill payment clearing house and built lists of rules of regular expressions to convert JITB#45 into "Jack In The Box."

Plus, if you don't log into your Money or Quicken for a few months, just try catching up and reconciling, especially if your bank only holds 90 days or less of account history.

I switched this year from Money 2006 to Quicken. Sadly, it's even worse. It paints unspeakably slowly, and in the 5 months I've been using it, it's updated itself at least three times, presumably in order to play well with Vista. Regardless, it's the same old story. Chasing data feeds in order to get my small mind around my smaller money. Even more, these OFX feeds that bring this data into Microsoft Money and Quicken may starting costing extra.

So, I stopped. I log into my bank's websites directly. I use their online tools, and they continue to get better, adding Ajaxy goodness, some powered by Corillian/CheckFree (my employer).

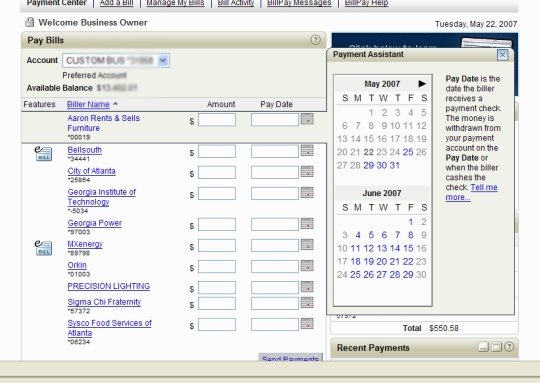

(By the way that's not a screenshot of my account...whoever that is did a lousy blurring job.)

(By the way that's not a screenshot of my account...whoever that is did a lousy blurring job.)

I never thought I'd say it and I know Chris "Mr. Desktop App" Sells will disagree vehemently, but if I can get an application online, I'm more likely to use it, and use it often.

Sure, a lot, if not all, of the cool features of a site like Wesabe could be had via a connected local desktop application, but then there's all the updating and what not.

Maybe there's a space in the world for a Personal Finance Manager - a MoneyKiller or QuickenKiller - written in Adobe Apollo, Flash or Silverlight. Maybe online apps that manage money will get smarter with new Browser Plugins like Google Gears (once there's a security story). Either way, I don't think the future of my money involves a 350 megabyte CD-based installer.

Do you use Quicken, QuickBooks or Microsoft Money? Do you connect to your bank from inside those apps?

About Scott

Scott Hanselman is a former professor, former Chief Architect in finance, now speaker, consultant, father, diabetic, and Microsoft employee. He is a failed stand-up comic, a cornrower, and a book author.

About Newsletter

I admit it; I frequently live paycheck-to-paycheck. It sometimes happens when, like me, you have two kids, a stay-at-home wife, and a debilitating gadget fetish (At least I'm putting a bunch into my 401(k)). The critical factor to my day-to-day financial planning is the ability to forecast how much discretionary cash I'm going to have after all my bills are paid.

I've divided my accounts payable into two groups: 1st of the month (due any time from the 1st to the 14th) and 15th of the month (due from the 15th to the end of the month). These date ranges also correspond roughly with payday cycles. About 7 days before the 1st or 15th, I process all of the bills in that group so that they are paid on payday. The bill payments are sent from within the PFM, so they are automatically entered in the register as future transactions. I enter a post-dated transaction that represents my estimated paycheck, and post-dated transactions to represent any ACH draws (water bill, car insurance).

The end result is that I can look ahead in my register and estimate with a fair amount of accuracy how much cash I can blow on gadgets, gifts, going out with the family, etc. The added bonus of the PFM is that my register, including my future transactions, is continuously automatically reconciled whenever I sync with my bank.

I also use 401(k) tracking, loan payment tracking (P+I, PITI, etc.), and asset/liability management. I always have a good idea of my net worth and what needs attention. I just cannot imagine tracking all of this without a PFM.

Side note: Am I the only one for whom the comment preview is rather... sluggish? At least in Firefox, anyway. I noticed this same problem on Phil Haack's blog back before DasBlog borrowed it from Subtext.

I left Quicken a couple of years ago. For three years before that I was the lead engineer for Online Banking. I can only say that Quicken is over twenty years old. The code reflects that. Any new app would be much smaller and more responsive, and, well, better. But the market isn't there for Intuit to invest that much. As for an online version solving the problem, as you pointed out, so many of the problems come from the banks themselves, an online version can't help that. And the banks want to keep you on their site, not using Quicken (and it's apparently working). As for OFX, what's the point of a consortium when none of the banks ever left version 1.5 or whatever they first implemented? Also, it will take a company with a lot of resources just to keep the info about the banks up-to-date (url, features, etc.). Some years ago Microsoft proposed a 1-way OFX that would help a developer a lot, and be cheaper for banks, but I doubt it's gone anywhere. It's easier than ever to write a new personal finance app, desktop or online. But I wouldn't want to be involved in the rat's nest that is online banking.

As for switching to a completely-online solution ... I haven't used any online banking systems other than my credit union's, so I don't know what else is available, but I don't have the ability to forecast my account balances online the way I can in Money. I *love* that chart that tells me what my bank accounts will look like over the next twelve months. Sure, it's not always accurate (unexpected bills always occur) but it does give me a general feel for when I can buy that next Xbox game etc.

However, it is much better than not doing any financial management at all. Tally is a very popular software in India but it's not half as cool (though double as functional) as MS Money.

After reviewing a lot of PFMs (a lot) I found Mvelopes, and it seemed to fit exactly what we wanted - with one problem: a monthly fee. After trying it for a month, I was on board. (Screenshot) It's a Flash-based app (and I credit it with giving me faith in Flash-based apps again) which "integrates" with something like 13,000+ online institutions. "Integrate" can mean using a semi-formal API, or screen scraping. So far their support has been very fast at repairing any problems with reading data from my bank/credit card/mortgage/401k/etc sites, and the number of problems has been relatively few and far between. Oh, and if you don't want to use the automatic downloading of transactions, you can use it 100% manually as well. One downside is that while you can import your historical data (i.e. from Quicken), it's just that - historical. You can't interact with it via the main UI, you can just run reports on it. That's usually all people want to do though, I'd wager.

I also like the "available anywhere" nature of online apps combined with the fact that backups are not my problem. Of course I could be instantly screwed if something goes wrong - but that's just a chance I'm willing to take I guess.

If there was some kind of way to integrate with Money, I'd be much happier with it. I'm going to look at some of the alternative mentioned above (besides GnuCash - tried it, not for me), and if one of them gives me that and does everything else in a reasonable manner, I will switch as quickly as I can convince my wife it's a good idea to spend yet another $50 on some piece of software that's supposed to make it easier to manage our money but really ends up wasting more time.

It's important for me to keep my own record of transactions and reconcile this with the bank's - in this way I can see that expected deposits have been made, for example.

Using MS Money also enables me to get a consolidated picture of our financial situation across many disparate accounts, and see a holistic view of our investment portfolios.

I have twelve years of history (I restarted from scratch with Money 2000, for reasons I can no longer remember) and it performs quickly on the PIII laptop in the kitchen.

Scott, perhaps you have too much money, and that's why the performance is so appaling?

I regret buying it, all it will lead to is more customer support calls and headaches and repeating the question again and again to different customer reps.

I wish you could have blogged about this earlier.

The problem with all of the online tools is that they are for paying bills, not tracking and reporting on your finances. I handle our investments across 8 or so accounts (401k's, IRA's, Rollover IRA's, 529's, etc) and Quicken has made that much easier. Updating Quicken from my financial institution seems slow but the total time required is immaterial. It also has plenty of bugs but nothing that causes me to lose data so, whatever. It is the only way for me to see how we are spending money and how my investments are doing quickly so I'll stick with it.

And as for banking in the Bahamas, I *have* to enter transactions manually into Money. The bank is using a decade-old version of the software of its parent company (Royal Bank of Canada) and doesn't support accessing accounts through financial software, or even downloading transactions directly into Microsoft Money. They claim Quicken support but I have my doubts.

What's worse is that I've also had to start using cheques again since moving here because they don't have a debit card system in place. Which now means I actually need to reconcile more diligently (also because they're prone to errors like depositing to the wrong account and screwing up exchange rates).

But I'm a little confused about how you can just stop using it. Yes, you can reconcile each account manually but what about an overall view of all your accounts? I don't go overboard with the features but I do use Money to keep track of my investments' current prices and to see what I'm spending my money on (which is more for fun; not like I change my spending habits after seeing what I bought in the past). And most importantly, to see, at least roughly, what my net worth is. I also use it to track my accounts receivable which is admittedly easier in a country that doesn't have income tax and where you don't need to incorporate.

Kyle

I agree that upgrades do little to improve the app. I stay current not because I think the upgrades are worth the cost, but because I don't want to get out of date and then have an upgrade nightmare if there is a feature I truly want.

My biggest pet peeve with Quicken is how early you need to pay something in order to use bill pay. When using bill pay on my bank's website, I need to pay a bill two days in advance. When using it in Quicken, I have to pay it 7 days in advance. To me that is ridiculous. I'm not the only one - a lot of people online complain about it. Lately I have stopped using Quicken's bill pay and started using the bank's bill pay. (That screen shot looked remarkably similar to my banks!)

I've thought about switching to another product, but I don't hate it enough to weather the pain I anticipate I'll have making the switch. And I do like some of the planning features available in Quicken. But on the whole, it is a sort of like/hate relationship, to be sure.

I've really only had one problem with reconciliation (Quicken even auto-reconciles for me after Online Update) and that's because my credit card provider recently tried to tack on a service fee for something and not include it in the Online Update feed. That was a one time problem and was quickly resolved by removing the fee period, not adding it within Quicken.

I did try to give MS Money a trial run about a year ago, but I've become to comfortable with Quicken to make the move.

If there were an online based alternative to Money or Quicken, would people really use it? If all it takes is for a single password to get cracked, do I dare trust that password and website with my most valuable personal data?

I've tried switching to MS Money and Quicken a couple of times over the years. Every time, the barrier of entry has just been too hard. Not to mention that the tool doesn't seem to really seem to improve my life. So I always end up switching back.

PS. Hey Scott? You're dynamic text entry box on this site kind of blows. I like the idea that its previewing my comment below, but using it in Firefox causes the text to lag WAY behind my typing speed. Not to even mention that typing leads Firefox to peg my CPU. This really shouldn't happen on a 3GHz processor with plenty of memory. I ended up typing out my comment in a text editor and pasting it into the box. :)

We only used it however to help us analyze our spending habits... with the primary goal of identifying excess spending. However, we would consistently overspend on certain stuff so we just haven't had the need.

I quit doing it sometime around 2 years ago. It would actually be handy if our bank (Wachovia) offered this sort of service on the web-based interface. By the way, the badly-blurred screenshot is either from a Wachovia account, or from some other bank that uses the same web interface as Wachovia. Kind of slow at times, but fairly nice. Occasionally unavailable though... I recall when we lived in the Midwest the bank we had accounts with had a much less viable web interface - so in comparison, ours now seems so much nicer :)

I'm definitely in agreement about using a webapp over a desktop app, but this is strongly backed by me background on developing web apps instead of desktop apps, and convincing those that would have rather had a desktop app why the web app is *better*. Mind you - I know there are scenarios where a desktop app *is* preferred and better, but I have always believed that you can usually provide almost all the functionality in a web interface (but it might take longer to develop/run/use/etc.). Either which way, I am *always* the web software guy (or part of that team) - never the desktop software guy. Not my cup of tea.

I agree with the comments about the "live comment preview" - no argument from me about pulling that feature. Especially horrible in FireFox (pegs the CPU + text delay in rendering).

Because banks are run by humans using computers programmed by humans. I can't count the number of times I've had to call the bank to track down a deposit that I made because someone keyed in the wrong account number.

I've tried KMyMoney for KDE. Hated it. I had gotten so used to Money 2000, I couldn't train my brain to use it. The same goes for GnuCash.

Personally, I don't know if I'd trust a 3rd party (say Google) to host my banking data. At least banks have federal laws governing them. Not that those laws mean anything to them...

In one case I had become so busy at work that I hadn't updated Money's accounts in about three months. As I sat down one weekend to reconcile all of my statements, I noted a serious bug that hasn't been fixed in a number of years. Enter a transaction that matches an overdue bill in Bill Payments (say three months or older) and Money goes into la-la land and never returns. I've reported the bug to Microsoft support several times over the years, but it still exists in Money 2007.

In another case, I wanted to backtrack a student loan that is coming due this year. I had put this off because the banks (in their infinite wisdom) make it extremely difficult to track and interpret student loans accurately. I swear they do this on purpose. Anyway, I opened a new account and attempted to enter the first disbursement. Microsoft Money's answer? "You can't enter a transaction with a date prior to the account creation date."

I think you also make a valid point regarding automated reconciliation. I have attempted to download statements from my bank, but the result is always the same: Money's accounts become a scrambled mess with duplicate entries and impossible to decipher goo that is more difficult to clean up than manually entering the data in the first place.

I've come to the conclusion that if I can find a product that actually works well, I would drop Microsoft Money like a hot potato. I get the impression that Microsoft is listening closely to the organizations paying for new features and ignoring the consumers that purchase the product. I haven't seen a new feature in Money over the last few years that helps me one iota and it still fails to correctly support limited user accounts.

PortableApps - OpenOffice.org Calc (Converted from Excel a couple of years ago, before that MS Money)

Stored on a 1gb TrueCrypt volume on a 2gb USB Drive, backed up nightly when docked at home.

Each "Sheet" of the workbook corresponds to one statement period (Paper statement) with beginning and ending balances reconciled. I maintain one calendar year per workbook so files never get all that large, and archives are very easy to maintain. Every couple of days I log into the web account of my banks and update the entries. This only takes about 10-15 minutes at a time. When bills are do, I update the balances for the periodic accounts on a monthly register of bills.

The reason I enjoy this system, is that it allows me to have the features I want and no more. I currently track my "burn-rate" (spending per day/month) to estimate the budget for gadgets, saving goals, a complete list of debts (darned A/C unit...), savings accounts, and a net-worth statement (very painful). Using this has shown me where to focus on my finances and pointed out some issues with how and when I spend my earnings.

In case OO.org Calc is a problem with anyone, yes it is large and bulky. But it still loads faster than Money 2007 and withthe portable apps, I can check from home, work, hotel, etc. (always minding the security). And I am often surprised at how much fun and even useful it is to have a spreadsheet calculator handy to do quick what ifs. "=Balance - (sum(this weeks spending)/7)*3" to see if there will be anything left over at the end of the month. Also very easy to find what month do I spend the most money, how much do I need to save to make the "no interest" payoff date on the house repair, etc.

A guiding principle for me is: keep it simple, keep the data open and accessible, and let the tools do the work.

-D

It just feels like there should be something (similar to Wesabe) that can help consolidate all these separate web-apps that are related... allow for tagging and sort of a more casual and modern 2.0 of getting organized. But what Wesabe looks to be missing (haven't really tried it) is a way to project expenses that will be coming up. Because what many of these comments are saying is what a dashboard is really about. Getting a good feel for the overall status of finances. So then, how about a mashup that would blend google calendar and maybe a todo list... personal online journal... weather... local news... medical data (like diabetes Bg numbers)... flickr photos and your financial transactions so you could really be able to go back and see just what was happening on a particular day? That would rock!

Wow, Scott...you started quite the conversation. ScW, we are hard at work developing tools that will better allow users to forecast their expenses.

We also allow data export to many different standards, so someone who wanted to export their data to an Excel spreadsheet that is also possible using Wesabe.

In the not to distant future we will also be opening up our API, so if Jeff wants to automate the process of forecasting for himself...maybe he will be generous enough to share his tool with the rest of us.

The PFM space is going through quite the transformation...but I think we are only at the beginning of the process.

Scott..your blog just went into my RSS reader

Mostly I wanted to comment on the monthly fee. In2m addresses that directly on their site (Mvelopes is actually cheaper to use than Money and Quicken) here: http://www.mvelopes.com/mvelopes/quicken.php

Honestly, I wish someone would come up with a better online (and offline) application that uses the envelope metaphor. But for lack of a better option, I will stick with mvelopes.

mgm

I think that Steve (Wilcox) has hit the nail on the head here, there is a big open space for a Quicken/Money killer... I made a blog comment elsewhere about this very fact not long ago. And I've been a Quicken user since '98, so I too have a lot of data.

Don't bother with Wesabe, I tried them only to discover that I couldn't punch in cash transactions! So if I bought $15 of groceries with cash from my wallet, I had no way to track that. Oh yeah, and it doesn't have a scheduling feature, which is pretty much required so that I can balance my stuff in advance, I mean, that's one of the big benefits, I know what my account balance will be once all of my cheques clear. Wesabe doesn't know your balance until after :(

I'm primarily a Forms developer, but I'm completely behind everyone suggesting that the "new app" should be a web app. What's being done is just so simple, that it really deserves to be hosted. As for integration, I love the Google integration idea (Google account, generate an RSS feed containing updated transactions, track important days on the calendar, etc.) But firstly, somebody needs to create something that just works and is as pretty as say Google Calendar or G-mail.

Contrary to Scott though, I would like to have something with a small monthly fee ($2-10). Quicken charges like $100 and "sunsets" features on you to keep you upgrading (meanwhile, I'm basically using the feature-set from '98 + transaction download). Now I know that Intuit offers the "Cash Manager" for $40, but that's online-only, 'cause they only want their savvy crowd to know about it. Personally, I'd rather pay $2/month for something that's actually providing me with a service on a regular basis. In fact, I'd feel much better handing them a small amount of cash, b/c then I know that they have money to spend on improvements and new hardware and security.

I'm definitely not a power finance user though.

I only tried Money once, quite a number of years ago, and when I did not find the MDI interface, I dumped it :)

While I do like some online apps, I still enjoy a quality desktop application, but Quicken is no longer one for sure. I would switch to something else if there was a choice other than just MS Money.

You said:

<< I took a look at MVelopes...they lost me on two points...Two, Monthly Fee? Their service should be offered through the bank, I think..." >>

If it turns out to add value to you, why would you object to paying? Or, why would you object to them charging? I agree on your second point - the best of all options would be the institutions themselves wrapping these services and offering them as free value-add. However many people do business with multiple banks and other financial institutions so that's where I see the 3rd party services coming in to pay. And for something 3rd party that makes my life easier, I'd gladly pay.

Matt

ps. The timing of this post is perfect. I wanted something to give me an aggregated view of my accounts and I was going to check out Money and Quicken, but now I'm steering clear.

When I upgraded to Money 2006 last year, though, it just exploded on me. 6 years worth of data, which amounts to about 14,000 transactions (often with detailed memos), got corrupted beyond repair, then duplicated, mismatched, and corrupted again. Hundreds of hours wasted, trying to recover. I ranted about this a few months ago, in a comment on My Personal Finance Blog [not mine really, that's just the name of it!].

Since posting that, I continued to struggle with Money 2006, through various means (Created new money files a couple times, did some more massive semi-manual data cleanups and imported/exported a lot of things, etc), but finally got *completely* fed up a few weeks ago. I just can't use it anymore.

So I've been toying with a couple of homemade excel spreadsheets, tried Wesabe, and GnuCash, and finally Yodlee MoneyCenter. I love the at-a-glance power that yodlee provides, though hit does make me nervous having one website with so much personal data. Although, Google already has access to all of my personal data, one way or another, since I use so many of their products and services every day, so if they were to buy yodlee (or created their own personal finance webapp), and integrate it with some of their other services, I would not be any more concerned about privacy than I am now. :)

Anyways, I am going to continue to play with Yodlee for now, and keep my eye out for more posts like this one (which always seem to bring out a lot of interesting and informative commentary from the masses). I like Yodlee, from what I've seen so far, but I have not played with all of its features, yet. I may end up going the spreadsheet route in the end, or I might try the physical envelope thing. I really don't know what I'm doing, at this point, and I'm anxiously awaiting a killer webapp to figure it out for me!

Now, I'm wondering if I even need something as "heavy" as GnuCash... Excel helps me balance the books, the rest of the information is online. Sure I lose out on categories and graphs with GnuCash, but honestly, I don't really use those features that often. Is Excel really all one needs to manage one's finances?

It's the "big picture" aspect of Money that keeps me using it, the ability to forecast my funds, to easily get a snapshot of what bills are coming up, to quickly change due dates, to look at my budget (yes, I'm probably one of 10 people in the world that actually use the budgeting feature in Money). Seeing at a glance the account balances of all my accounts and being able to schedule bills from a single source is how it should be.

Ironicly ajax infused sites are actually less productive for me since half the ajax implimentations get their headers mungled by my work's firewall so I don't have that "work from anywhere" ease that ajax and web 2.0 are supposed to bring.

After reading everything on here, it sounds like maybe I should never upgrade from Money 2004 if I want to keep my information!

<a href="http://www.codelandia.com/jaws/index.php/contents/mySharpCash.html> #cash</a>

The forum is here:

http://www.codelandia.com/phpbb/index.php

Right now it only supports the basic OFX downloading, but it does get maintained and updated regularly.

Last month I started feeling kind of guilty and decided I'd better ask my financial institution if they minded me "screen scraping" my transaction data, even though the User Agreement did not prohibit this. I tried to politely word the question in such a way as to let them know that I was not trying to bypass their web interface and that I was still using HTTPS security, usernames and passwords and was only trying to access my own account. But, I guess when you're talking to a bank and you use phrases like "screen scraping" and "scripts" it makes them kind of nervous. Long story short, they kindly informed me that even though I'm not technically violating the User Agreement, they would prefer I not do it. I certainly understand that and respect their wishes. They've been a great bank in all respects other than this. However, this is fairly important to me, so now I'm looking for a new bank....

The truth is, I'm 99% certain the bank would have never known the difference between a real web browswer and my "libcurl" script. But, I like to play by the rules and didn't want to violate the "spirit" of my user agreement.

In the interim, I've modified my web app so that I can upload a *.QIF file to get my data in Postgresql. But, this feels like a huge kludge and means that I have to put some effort into getting the data.

The problem is, I can't get anyone at any of the banks I'm interested in to respond to my inquiries about OFX or granting me permission to "screen scrape" the web interface. I really prefer to "roll my own" application so that I can have a web interface to my personal finance data. So, using Quicken or MSMoney is not an option.

Can anyone offer any advice about the legality of "screen scraping" or how to get banks to "open up" about their OFX server? I'm perfectly willing to rewrite my own scripts again. I just don't want to waste my time if the banks are not willing to openly allow me to do so. I'm not a renegade and prefer to follow the rules and wishes of the bank.

I've also asked the question about a Google PFM. I love the idea of a cross-platform, online PFM. But, I'm not sure how comfortable I'd be giving company that makes money by presenting "relevant" ads access to all my transaction info (cash purchases included.) Yikes!

Of course, MS Money displays a rediculous amount of ads and "services" for an app that costs $70.

My two cents.

Comments are closed.